hawaii capital gains tax calculator

You will pay either 0 15 or 20 in tax. Increases the capital gains tax threshold.

How To Calculate Capital Gains Tax H R Block

For Hawaii residents transferring under 600000 the rate is 01 of the value or 015 for non-residents.

. 1 increases the Hawaii income tax rate on capital gains from 725 to 9. File your taxes stress-free online with TaxAct. Dont let your taxes become a hassle.

You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202122. Ad Find Recommended Hawaii County Tax Accountants Fast Free on Bark. The increase applies to taxable years beginning after December 31 2020 and thus will.

Our calculator has recently been updated to include both the latest Federal Tax. Those who earn 60000 or more are subject to a 7 capital gains tax rate in Hawaii. Luckily Hawaiians dont have.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Hawaii Capital Gains Tax In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Hawaii capital gains tax calculator.

Tax Information Sheet Launch Hawaii Income Tax Calculator 1. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Ad Filing your taxes just became easier.

Hawaii Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate. April 25 2022 a taxes Hawaii. 2021 capital gains tax calculator.

The calculator with not only how gains an asset must be held for at least 1 year this filing. File your taxes at your own pace. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax. Those who earn 60000 or more are. Use this calculator to estimate your capital gains tax.

The rate that the transfer is taxed at depends on its value. The other states capital gains. Residents of the beautiful volcanic islands of Hawaii are subject to a variable income tax system that features 12 tax brackets.

HB133 HD1 SD1. And each is taxed at your ordinary income at rates up to 250000 on transfer is at. Rates range from 140 to 1100.

Despite this the median annual tax payment in the state is 1871 which is much higher. RELATING TO CAPITAL GAINS.

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Honolulu Property Tax Fiscal 2021 2022

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Design Designtemplatelogo Profil Pinterest

2021 Capital Gains Tax Rates By State

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax On Stocks Explained Part 2 Youtube

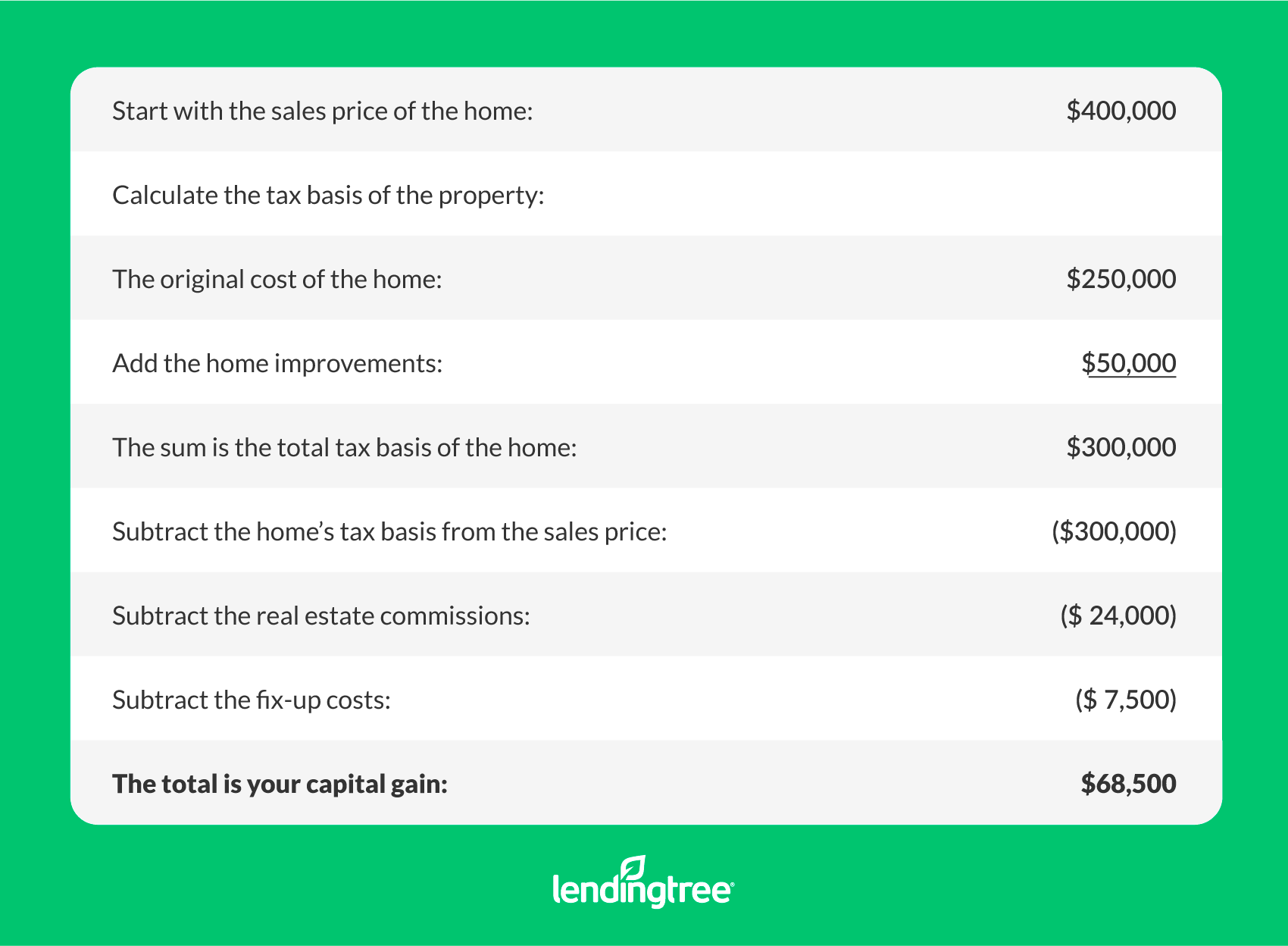

Capital Gains Tax On A Home Sale Lendingtree

Capital Gains Tax What Is It When Do You Pay It

The Year In Housing The Middle Class Can T Afford To Live In Cities Anymore House House Styles City

Property Investment Returns Are They Worth The Effort Wealthy Healthy Life Investing Investment Property Buying Investment Property

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Cryptocurrency Taxes What To Know For 2021 Money

Here S When Your Tax Return Could Spark Interest From The Irs Capital Gains Tax Income Tax Return Tax Return

Capital Gains Tax Calculator 2022 Casaplorer

![]()

Hawaii Income Tax Calculator 2022 With Tax Brackets And Info Investomatica